For years, compensation has been treated like a cost center. It’s a necessary line item to be managed, benchmarked, and justified. HR and compensation teams tracked comp ratios, salary bands, and internal equity metrics to ensure fairness and compliance. But here’s the uncomfortable truth: those metrics rarely tell you whether your pay strategies are working.

As Phil Taylor, Director of Financial Services at Willis Towers Watson, put it during our recent webinar:

“Traditionally, compensation and benefits teams have relied on relatively narrow metrics like comp ratios and internal equity. But we haven’t really looked at whether employees are delivering value.”

That’s the missing piece in most compensation conversations today. We measure what we spend, but not what we get back. In a labor market defined by skill shortages, hybrid flexibility, and rising expectations, that’s a dangerous blind spot.

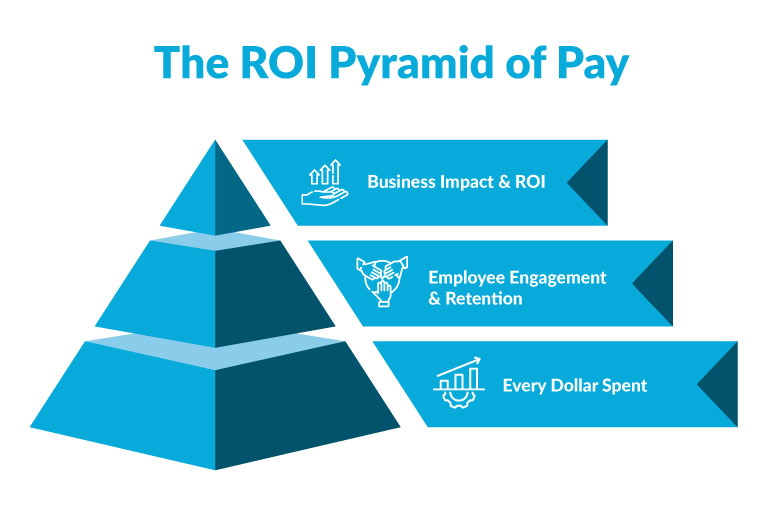

The next evolution of compensation strategy will link every dollar spent on rewards to measurable business outcomes: engagement, retention, and productivity. Because if compensation remains disconnected from ROI, it stops being a strategy and starts being an expense.

From Compensation Management to Compensation ROI

For decades, compensation management was about control – budgets, salary bands, and benchmarks. It was transactional: ensure compliance, avoid inequity, stay within market range. But as Phil Taylor pointed out in the webinar, that old model no longer fits the modern workforce.

“Workforce costs are obviously the single largest expense for most companies,” said Phil. “And competition for talent is fiercer than ever. The question now is what’s the return on every dollar we spend?”

That’s the shift: from managing compensation to optimizing total rewards.

Every pound, dollar, or dirham spent on pay, perks, and benefits must now be tied back to measurable outcomes – engagement, retention, and productivity.

Forward-thinking organizations are treating compensation like an investment portfolio, not a payroll ledger. They analyze what mix of fixed pay, variable pay, benefits, and recognition yields the highest engagement and lowest attrition. They personalize reward structures to employee demographics, career stages, and even motivation types, because what drives a millennial data analyst in London isn’t the same as what retains a senior relationship manager in Dubai.

Phil summed it up well:

“Some of my clients are experimenting with real personalized approaches to compensation beyond what we used to see from a flex-benefits perspective. They’re looking at how the entire compensation composition works: what percentage goes into basic, variable, or retirement.”

This is where compensation strategy meets analytics. HR leaders who can model, predict, and adapt reward structures in real time will define the next generation of high-performing organizations.

The Data Layer

Personalization in compensation isn’t about paying everyone intelligently.

Bineeta, Senior Manager of People Analytics at SplashBI, captured this perfectly during the webinar:

“It’s so important for an organization to have a compensation philosophy that defines how they position themselves against the market. Not every organization can compete with a billion-dollar company, which is why it’s even more important to define how they show up.”

That “showing up” begins with data. A well-defined compensation philosophy paired with a clear leveling architecture helps organizations clarify not just what they pay, but why they pay it. It gives structure to career progression, role hierarchies, and pay differentiation, ensuring that compensation aligns with both external competitiveness and internal equity.

But the real transformation begins when analytics enters the picture.

Bineeta shared an example from a project with the U.S. Olympics & Paralympics Committee, where the goal was to connect compensation to the bigger picture.

“We weren’t just looking at pay,” she explained. “We linked it with demographics, shift patterns, tenure, training, and sentiment data. That’s what lets you see not just what you’re paying, but why and to whom.”

The results were eye-opening. Once those data layers came together, leadership could instantly see where pay practices affected retention, where bonus structures were actually working, and how compensation aligned with organizational priorities.

That’s what data does. It turns compensation into a living system, not a static spreadsheet.

The goal is to pay smarter. HR leaders today need to design compensation strategies that reflect the workforce’s reality, reward performance meaningfully, and drive measurable ROI.

Why “Perfect Data” Is the Wrong Starting Point

If there’s one myth that holds back most analytics initiatives in HR, it’s this: “We’ll start once our data is clean.”

Phil Taylor has heard it too many times to count.

“I definitely hear, ‘our data isn’t good enough’ or ‘it’s incomplete, so we can’t start analytics,’” he said. “But the truth is that if we keep waiting for perfect data, we’ll never start.”

His point cuts to the core of HR’s data problem. The issue isn’t always the data itself. It’s the lack of ownership and accountability around it. HR functions often sit on massive volumes of information scattered across talent, comp and benefits, and performance systems. But as Phil noted, “There’s no clear ownership. Everyone has something, but it’s inconsistent. The problem is mindset, not data.”

Bineeta agreed, and flipped the narrative on its head:

“It actually works the other way around,” she said. “The only way you get to cleaner data is by shining light on it through analytics. Once you start analyzing, gaps, inconsistencies, and errors naturally surface. That visibility is what drives data quality.”

That’s the iterative loop modern HR analytics thrives on:

Analyze → Expose → Improve → Repeat.

Every analysis you run reveals inconsistencies. Each inconsistency sparks a conversation about ownership and process. Over time, those conversations create accountability that keeps data clean, not the other way around.

Waiting for flawless data doesn’t eliminate risk. It delays ROI.

Because while you’re preparing, the organizations that start small are already learning, iterating, and building their comp intelligence edge.

Predictive Analytics: The New Lens on Pay Equity and Retention

If descriptive analytics helps HR teams understand what happened, predictive analytics helps them understand what might happen next and why.

Phil Taylor explained that predictive modeling is already transforming HR’s approach to retention and compensation strategy:

“Across the employee lifecycle, the biggest demand for predictive analytics right now is around flight risks and retention,” he said. “When you consider that attrition can exceed $150,000 per employee once you factor in onboarding and productivity loss, organizations want those early warning signals, and the chance to act before it’s too late.”

By correlating compensation patterns with tenure, engagement scores, and performance data, HR leaders can now forecast turnover risk and identify the pay or progression imbalances that often sit at the heart of attrition. This doesn’t just save recruitment costs — it strengthens equity and trust inside the organization.

But as Bineeta cautioned, predictive analytics isn’t a “magic pill”:

“There’s a lot of spotlight on predictive analytics, but I’d be cautious about buying a readymade solution that promises to predict everything. Unless your model understands your people, your pay structure, and your data history, it can’t give you reliable results.”

She emphasized the importance of interpretability, or knowing why a model makes a prediction.

“Several models can predict outcomes accurately,” she explained, “but not all can tell you why. We use algorithms that balance accuracy with interpretability, so HR leaders can not only predict attrition but also understand the drivers like pay, promotion, or training.”

This transparency is what gives predictive analytics real power. When HR can see both the signal (who might leave) and the reason (why they might leave), they can test interventions, measure impact, and refine strategy — all before attrition becomes a headline metric.

With platforms like SplashBI’s built-in predictive engine, leaders can go one step further – estimating the cost of attrition, simulating how adjustments in pay or incentives shift outcomes, and even generating AI-driven recommendations for where compensation reviews are most needed.

Predictive analytics, done right, turns compensation from a discipline of foresight rather than hindsight.

The Future of Compensation: Human Strategy, Data Precision

If there was one theme running through the entire discussion, it was this: HR’s role is evolving from policy keeper to custodian of productivity.

As Phil Taylor predicted, the HR function of the future won’t just manage pay structures or compliance processes. It will orchestrate performance, using data to align compensation, engagement, and business outcomes.

“The whole HR function is fundamentally changing,” he said. “We’re stepping away from processes and policies. We’re becoming custodians of productivity, looking at how every part of the people function drives impact.”

Artificial intelligence and predictive analytics will play an increasingly central role in this transformation. Modeling, scenario planning, and conversational analytics will automate many of the manual aspects of compensation planning, allowing HR to focus on strategy and storytelling rather than spreadsheets.

But Phil also issued a warning: as HR leans more on automation, it must double down on the human side of leadership.

“AI will bring major productivity gains,” he noted, “but we have to make sure trust, culture, and wellbeing aren’t lost in the process.”

Technology will tell HR what’s happening, but empathy explains why it matters.

The future of compensation lies in this balance: human strategy powered by data precision.

For organizations ready to start, the roadmap isn’t complicated, but it does require intent:

- Step away from descriptive metrics. Move beyond tracking pay ranges or turnover rates to understanding why they occur.

- Assign ownership for data. Clarity around who maintains and governs compensation data creates lasting accountability.

- Start small, prove value, scale up. Pilot one high-impact analytics use case, demonstrate ROI, then expand the framework across the enterprise.

Because the companies that treat compensation as a living system – dynamic, data-informed, and deeply human – will be the ones that not only attract great talent but also retain it.

Conclusion: Compensation Isn’t an Expense. It’s an Investment

The future of compensation is about spending wisely. Every pay decision, perk, and policy should create measurable impact on engagement, retention, and productivity. The organizations that get this right will stop viewing compensation as an expense line and start treating it as a growth strategy.

Want to hear how experts from Willis Towers Watson

and SplashBI decode the ROI of rewards?