Multiple surveys over the past decade have indicated that people involved in finance reporting consider long-term planning and business advisory within their scope of work. However, the harsh reality is that 75% of their time is taken up by repetitive data gathering and administration.

Closing the books at the end of the year is among the highest-impact activities undertaken by finance professionals. This usually involves reconciling accounts, generating financial statements, reviewing performance, and ensuring compliance with tax and regulatory requirements. It is in every organization’s best interest to ensure that finance and accounting teams can perform these complex, time-consuming tasks efficiently and reliably.

Many organizations have reduced reporting complexity by turning to financial reporting tools like GL Connect. This post examines the nuances of year-end reporting and how GL Connect helps streamline year-end financial processes, allowing finance teams more time to focus on long-term planning, action, and advisory.

Year-End Reports: The Single Source of Truth

Year-end financial closure is a cornerstone of maintaining fiscal transparency. It ensures financial segregation, ensuring that a given year’s finances are independent of the next. Without distinct annual financial closures, businesses risk tax inconsistencies, potentially inviting legal complexities.

These reports also serve as a diagnostic tool, shedding light on a company’s annual performance. They become critical instruments for trend evaluations and benchmarking. Most importantly, closing the year’s finances clears the slate for the subsequent year.

The complex nature of reporting – compounded by differing requirements across geographies and reporting standards – make it a time-consuming task for finance teams. Given the time constraints and high stakes, many finance professionals prefer Excel’s time-tested reliability.

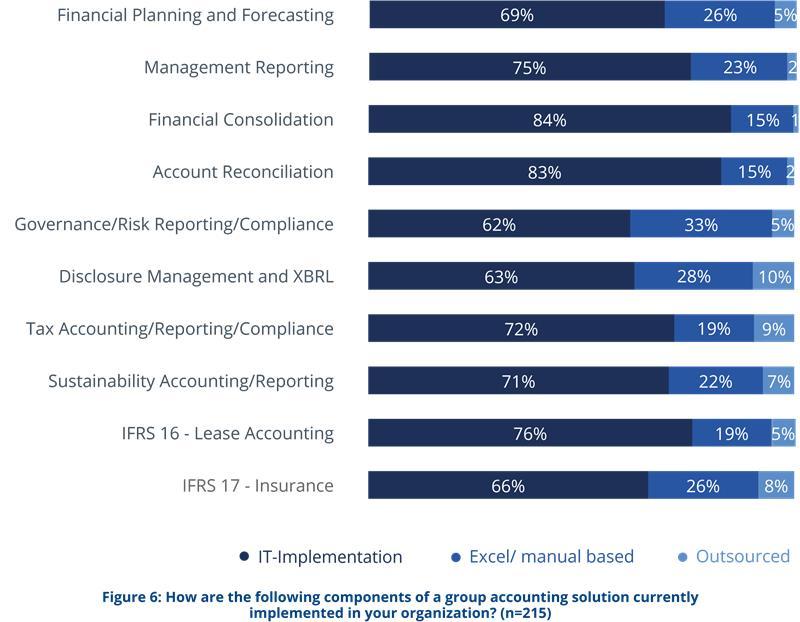

Despite the arrival of specialized financial tools, Microsoft Excel remains popular among finance and accounts teams. The 2022 BARC survey highlights that one in five finance professionals still use Excel as their primary financial consolidation tool. Excel usage averaged around 15% in Finance and Accounting.

While a significant number of companies are switching to dedicated IT implementations for financial reporting, Excel still has some advantages:

- Excel’s wide use since the 1980s has made it universally familiar to finance professionals.

- Excel’s easy availability and customizable features serve as a bridge between teams and companies that use different financial solutions.

- The competitive pricing and versatility of Excel present finance teams with the option of building reporting mechanisms without relying on IT teams.

Considering all the factors stacked in its favor, it is unsurprising that Excel is a popular choice for year-end financial reporting. The ease with which data can be manipulated and visualized in Excel makes it popular among finance teams. These same characteristics can also be cause for concern in the context of complex financial reporting. Logic written into workbooks is easy to duplicate and challenging to maintain. In the long run, this can lead to inefficiencies and reporting errors.

Is New Age Year-End Reporting Possible Within the Comfort of Excel?

Excel is difficult to scale as organizations grow in size and complexity. Finance professionals have a tough decision between the familiarity of Excel and the demands of scale, as underlined by Thomas McIlheran, Vice President of Financial Planning Analysis at Diversified in a CFO.com feature.

Reporting tools should be viewed through the lens of what they allow their users to do and the ease with which they can do it. Given Excel’s wide availability and industry penetration, GL Connect is designed to work flawlessly with Excel. It preserves everything finance professionals love about Excel while adding critical features, allowing it to keep up with dedicated reporting tools. This design ensures finance professionals can generate accurate output using a familiar tool without additional complexity.

GL Connect Excel integration gives year-end reporting a boost under the hood by:

- Enabling easy General Ledger balance update with single click refresh of worksheets and workbooks

- Supporting granular drill-down from GL balances to allow individual stakeholders to retrieve customized data across Balances, Journals, and Subledgers.

While the interface remains simple and familiar, GL Connect ensures the data is dynamic for reduced error rates. GL Connect pre-built templates and support for on-premises and cloud-native environments minimize setup time and reporting complexity. To top it off, hierarchical financial summaries also ensure that all reports generated are clear and understandable.

Security is another dimension businesses should consider as they scale, especially in sensitive issues like company financials. GL Connect accounts for this by retaining Oracle security, supporting SSO and static reporting.

Repetitive Reporting and the Case for Automation

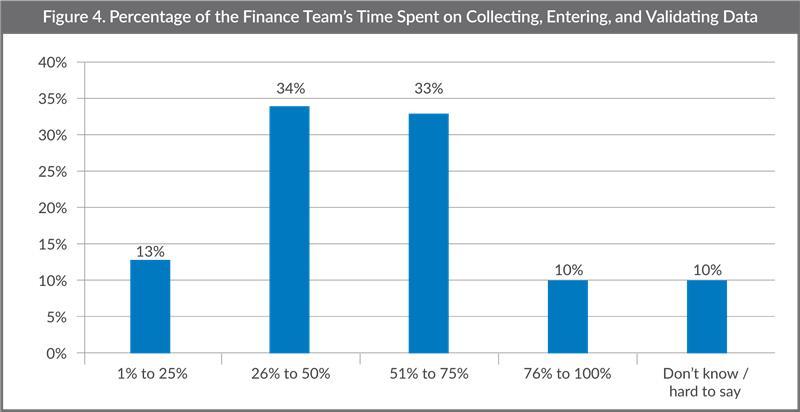

The IMA survey highlighted a palpable dissatisfaction with the prevailing closing processes – 55% of respondents hinted that automation could allow more time to be spent on strategic business initiatives. A large part of the effort involved in the closing of books is related to data collection, entry, and validation – all of which can be simplified through automation.

With GL Connect, finance professionals automate a large majority of reporting tasks, such as:

- Importing data from multiple sources

- Consolidating data across different entities

- Applying accounting rules and adjustments

- Generating standard and custom reports

- Distributing reports to stakeholders

Beyond speed gains, GL Connect automation capability also reduces room for error in reporting. Mistakes made during manual data import and updating of Excel workbooks can compromise data. By consolidating data refresh across sheets and workbooks to a single click, GL Connect significantly minimizes the potential for user error. Finance professionals can also use GL Connect to automatically share reports, distribute financial packages, and maintain access control. This ensures teams dependent on the same data can trust its reliability and reduce repetitive work.

Accuracy in Financial Reporting: Why It Matters

Accuracy is the central pillar of financial reporting. Elegant data representation is of no use if the numbers do not add up. Regulatory frameworks mandate rigorous standards for tax assessments, and failing to meet these standards can lead to hefty penalties. Only through impeccable reports can businesses portray their authentic financial status, guiding informed decision-making. GL Connect is designed with the understanding that stakeholders rely on financial reporting to measure company health and assess strategies and investment decisions.

Reconciling data with GL Connect ensures your reports are up-to-date and available only to those you want to share them with.

With GL Connect, your financial reporting becomes accurate, reliable, and compliant. This diligent adherence to recognized accounting standards reduces the risk of penalties, fines, or reputational damage due to non-compliant reporting.

Enhancing Efficiency in Year-End Processes

Year-end financial processes are riddled with complexity. From the nature of the financial framework in play to the diversity of assets and liabilities, the challenges are manifold. Mismatched information systems, often operating in silos, further exacerbate the complexities.

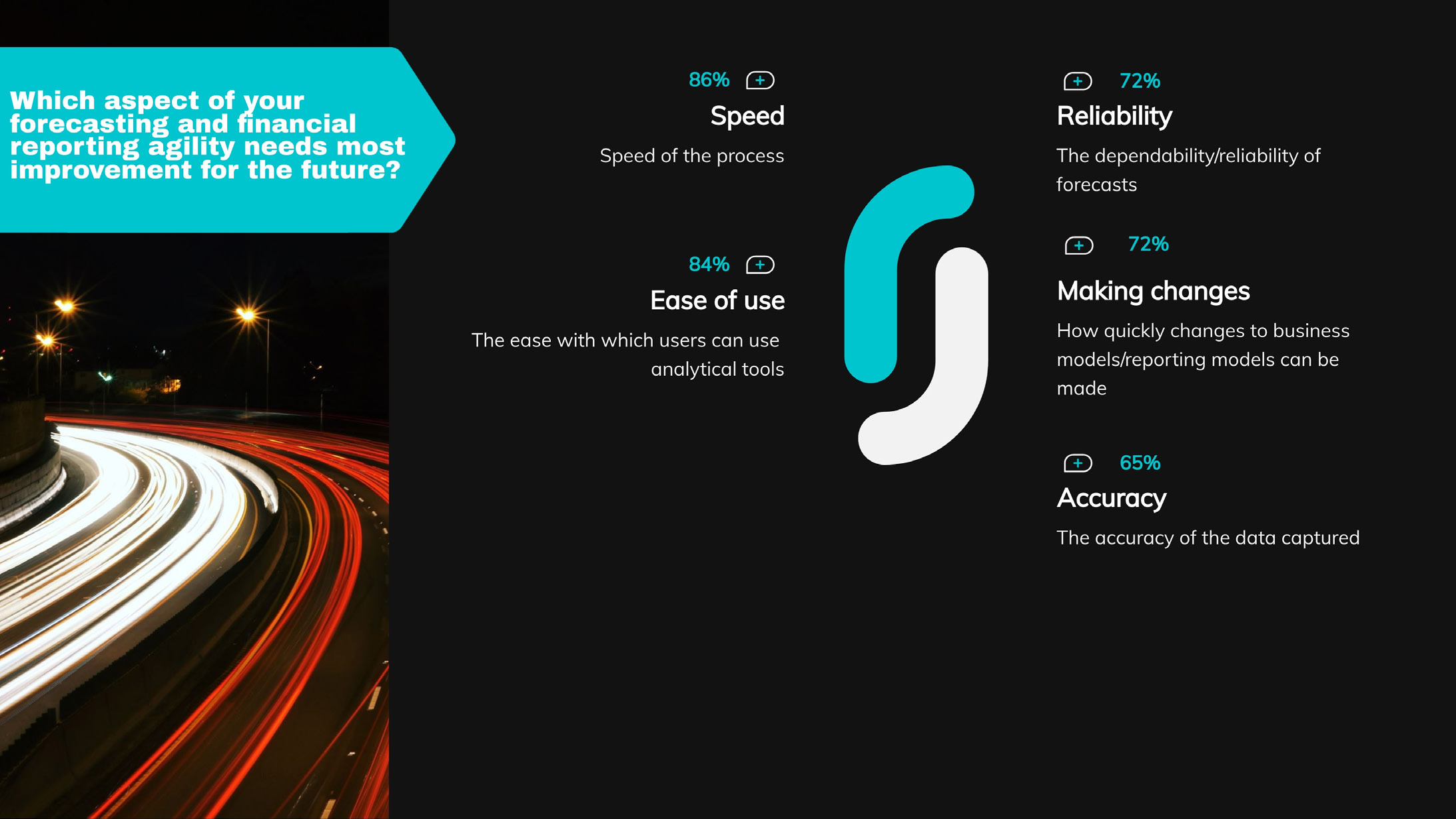

The Excel spreadsheet also remains a double-edged sword due to its difficulties with scale and dynamic data. While most businesses swear by it in the spectrum of accounting, it is also recognized as a bottleneck and source of errors. Modern finance and accounts teams prefer striking a balance between the simplicity of Excel and the features of modern financial tools. A 2022 Budgeting, Planning, Forecasting and Reporting survey by FSN confirms this sentiment. It indicates that standalone spreadsheet use is expected to decline by 10% by the decade’s end. Simultaneously, centralized database-linked spreadsheets will grow by 50%.

GL Connect brings a solution that integrates disparate data sources, ensuring a more unified and coherent year-end closure. Technological shifts, although largely beneficial, can usher in new challenges. GL Connect addresses these challenges proactively with its ease of integration, user-friendly interface, and reliable accuracy

The Solution to Reporting Scale is in Optimal Tech Interventions

As reporting effort, compliance requirements, and complexity increase, businesses cannot underprioritize the value of preparation in their financial reporting workflows.

Given the periodic nature of annual reporting, many finance teams are not very confident about adopting forward-looking interventions to their reporting processes. Among the participants in the FSN survey, 75% said they can devote less than three months to transformation processes. Nearly 80% of finance executives cited reliance on IT and automation as the solution to better data quality. Other common challenges brought up by finance and accounting executives include staff resources, current software systems, correcting data errors, and lack of IT resources. The integration between finance and tech is emerging as a significant element in the future of finance reporting.

GL Connect sits at this intersection, empowering finance teams to improve their annual reporting workflows in a familiar environment without any major overhaul to their existing infrastructures and toolkits.

Tools like GL Connect mitigate the risk of future technical debt and time cost on workflows that have been around for decades. GL Connect, with its thoughtfully considered feature set and a deep emphasis on real-time, error-free data, empowers finance and accounting teams to navigate year-end reporting with finesse.

Rafael Torres

Director of Financial Reporting

Rafael Torres directs Financial Reporting at SplashBI. With over 25 years in Accounting, Finance, and 13 years in IT, he stands at the crossroads of tech and finance. Starting with Oracle in corporate accounting, Rafael found a zeal for simplifying processes. He’s the Product Owner of GLConnect and GL Connect. Fluent in three languages, he aids global businesses, liaises with sales and marketing teams, and is keen on sharing knowledge to maximize business operations.