The end of the month is a challenging time for many accountants and financial analysts as they race to close their books and complete their reporting on time. Whether they are using Oracle Cloud or on premise solutions, the final hurdle has its highs and lows. With accounts to reconcile and financial statements to analyze, accountants and financial analysts are left with little time before the crucial deadlines are in front of them. As a result, time needs to be maximized so that they have all the answers at their fingertips when presenting to the business, board members and executives. These are the aspects of the role that financial analysts adore – and manual intervention shouldn’t be the blocking stone of success.

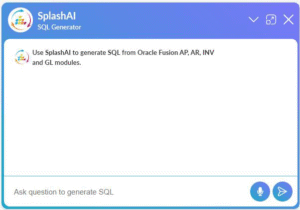

Preparation for month-end reporting involves financial analysts spending long periods of time focused on analyzing spreadsheet after spreadsheet. Tiffany Newkirk, Financial Solutions Manager at SplashBI, explains that month-end reporting shouldn’t be as problematic and frustrating as it is. To move forward, financial analysts need to incorporate technology to provide a visual representation of the data so their role becomes as efficient and sustainable as possible.

A New Beginning

Overtime and stress are two common issues that accountants and financial analysts experience when completing month-end close reporting. As many as one in four financial analysts describe the pressure of financial reporting being overwhelming, resulting in employees leaving the job they love; a situation that no senior management team wants to occur.

According to a recent survey, as many as 73% of accountants and financial analysts are still operating in a manually intensive, spreadsheet-driven system that limits or removes any time for analysis. In the same survey, 84% said they would prefer the financial close process to take up less time, that could in turn be devoted to more strategic financial projects. From a health and wellbeing perspective, the drive to utilize technology will help improve the efficiency and accuracy, especially at this turbulent time, and allow more time to be spent exploring the results and having the answers readily available for senior-level discussions.

A long-awaited Transition

Companies of all shapes and sizes have long sought ways to streamline their processes so that accountants can spend less time collecting numbers and more time analyzing the impact and results with senior stakeholders. Finding the right equilibrium between speed, accuracy and employees’ needs is key, and financial experts need to embrace technology and its visual qualities in order to achieve this.

While spreadsheets are a useful tool, they can be prone to errors, especially if formulas are entered incorrectly. Management teams want to understand the implications of the data in front of them, and with the aid of financial experts, bring the data to life in a much more visual and empowering way, ready to spot the next business opportunity. Working solely in a spreadsheet rarely allows this to happen.

Instead, technology can help drive smarter decisions, by making the data come to life and presented in a variety of visual formats. By combining the numerous, disparate systems required to achieve a successful month end close, financial analysts and CMOs can view real time data at a click of a button to make informed decisions in the future.

Conclusion

In an increasingly digitized world, real time financial reporting and accurate forecasting are more vital than ever to achieve a sustainable and efficient business model. Given the circumstances faced throughout 2020, effective financial management provides businesses with a competitive advantage and greater insights to drive profitability and efficiency.

Letting go of tired and archaic practices will drive financial roles forward and open the door for a myriad of opportunities when accountants and financial analysts expand their reliance on technology and move away from traditional methods. Moving forward, organizations that don’t incorporate technology into their month end reporting will be left behind, and not reap the rewards. It’s time for the face of financial reporting and analytics to change to become a seamless, stress-free and data-driven process.