Accurate financial reporting and analysis form the foundation for the success of businesses of all sizes. Financial reporting is crucial to organizing and managing your company’s finances and making informed business decisions. However, it is easier said than done.

Your finance teams work through hundreds of documents and financial statements – invoices, account receivables, salary statements, in-country taxation regulations, and more every single day. Stakeholders, both internal and external, need to have a transparent view of the company’s profitability, growth, budgets, etc., to make financially prudent decisions. This complexity increases manifold as your business grows.

Although financial reporting in excel is common, it can be tedious and time intensive. However, with the right set of tools and technologies, enterprises can experience seamless financial reporting with access to detailed insights in real-time.

Before we get into the nitty-gritty of financial reporting software, let us understand the meaning of financial reporting.

What is Financial Reporting and Why Enterprises Need It

Financial reporting is the practice of documenting a company’s financial activities and performance using financial statements. Simply put, financial reports provide a detailed view of a company’s performance over specific periods (quarterly or annually), shedding light on its fiscal status. Typically, there are three types of financial reporting mechanisms, namely:

1. Income statements:

Also referred to as a profit and loss statement, the report highlights the company’s overall income and expenditure. The end goal is to understand whether the business is making money or not.

2. Balance sheets:

These provide a complete overview of the company’s financial health at a given point. This financial statement provides detailed visibility into business assets, liabilities, and stockholder equity.

3. Cash flow statements:

This report highlights the amount of cash being generated and spent at a given time, usually over short periods. To develop an error-free cash flow statement, you must also ensure that the income statement and balance sheet are accurate.

The Secret Sauce – Must-Have Features for Any Financial Reporting Tool

The finance teams spend days, sometimes even weeks, making sense of data and developing effective fiscal strategies. However, finding individuals with the right skills and experience can be a daunting task. Moreover, manual data reporting is a hassle.

Choosing the right financial tool enables businesses to draw financial analysis from every possible viewpoint. In addition, intelligent financial reporting software opens up opportunities to develop sound strategies and enhance business performance.

![The Secret Sauce for Financial Reporting Success [9 Tips Revealed] 1 The Secret Sauce for Financial Reporting Success [9 Tips Revealed] 4](https://b1005447.smushcdn.com/1005447/wp-content/uploads/2022/07/secret-sauce-financial-reporting-toolblog-blog.png?lossy=0&strip=1&webp=1)

Let us explore some of the essential features of a financial reporting tool:

1. Ability to build financial reports

To make data-driven, fiscally sound decisions on the go, enterprises need to have access to accurate financial statements. In addition, the data needs to be compiled and presented per the business needs. Therefore, the ability to build reports effectively forms the core of your financial reporting tool.

2. Allow the flexibility to work with Excel

To this day, Microsoft Excel remains one of the most preferred accounting tools, with 54% of businesses using the software. Accounting teams, in general, continue using Excel for data analysis and reporting, where they can easily apply Excel best practices. However, even the most seasoned Excel users are prone to human errors due to manual data insertions and manipulation on this software.

An effective financial reporting software should be able to remove these human errors with report-building and data manipulation capabilities on its platform. But at the same time, the tool should allow users to download these reports in Excel format since most accounting and finance users are well-accustomed to Excel’s interface.

3. Enable reports to be drillable to the last detail

Finance reporting should be made accessible to all stakeholders across the organization to enable data-driven decision-making. However, different stakeholders of finance reporting have diverse requirements. For example, HR might need a quick preview of the compensation and benefits, whereas CFO/CEO need a 360-degree view of all profit and loss. On the other hand, marketing teams often need to understand ad spending and ROI.

Financial reporting and analysis must be drillable, enabling users to click on any line item and view the transaction details. At the same time, reporting tools should be able to prevent alterations and ensure data integrity.

4. Respond to inquiries on the go

With the advent of Covid-19 and subsequent lockdowns, businesses have adopted remote and hybrid work models to maintain business continuity and productivity. We live in the era of a connected, on-the-move workforce. According to PwC research, 75% of financial services employees found work-from-home to be productive, and 35% want remote work to become a full-time option.

In the light of these developments, it becomes critical that financial reporting software and tools respond to inquiries and deliver financial insights and reports without the user having to be in the office. An intelligent reporting system should be accessible to all relevant users and provide a single source of truth for effective fiscal decisions in a location-agnostic manner, while recognizing the security of the source.

5. Deliver a strong security posture

Financial data is the sensitive data set in enterprises. Data integrity is critical to ensure that sensitive information is not exploited. A finance reporting solution must meet the data protection and security guidelines to prevent breaches of any kind.

When looking for the right software, companies should look for stringent features such as two-factor authentication, automated notifications for sign-ins, SSL encryption, advanced firewall, and role-based access management.

6. Ability to connect with multiple databases

Holistic reporting means accounting for all financial data and other insights that impact the financial posture of an organization. These data sets are usually in silos, spread across systems and tools.

A robust financial reporting software has the ability to connect these diverse databases across on-prem, hybrid, and cloud environments. By connecting multiple databases, these financial reporting tools deliver the most holistic reports possible. These reports then empower stakeholders from different business functions to understand how their workstreams impact the organization’s performance and act on these insights. By investing in an intelligent reporting tool, businesses can also mitigate data redundancies early in the reporting process.

7. Deliver pre-built templates for analysis

Time is of the essence for finance teams. They should invest their capabilities in delivering data-driven, actionable fiscal insights and advisory, not just building reporting templates. An intelligent financial reporting software comes with pre-built templates that enable teams to focus on more strategic and value-driven tasks.

Besides saving time and effort, custom templates add a professional, consistent touch to financial reporting.

8. Streamline month-end process

It won’t be a stretch when we say month-ends give nightmares to finance and accounting teams. Number-crunching, analysis, reporting, delivery – there are so many moving parts! Having a streamlined month-end closing process reduces mistakes and improves efficiency. However, legacy tools are not well-equipped to streamline the accounting and often just add to the mess with errors, complex UX and time-intensive processes.

A new-age finance solution automates many reporting tasks, provides 360-degree visibility into numbers and analysis, and has excellent UX for quick data governance, orchestration, and reporting. All of this together helps your finance team to achieve consistently fast and accurate month-end closures.

9. 360-degree view of your financials

Companies have scattered information across databases, making it challenging to attain a centralized view of the data. In addition, larger organizations across geographies find it challenging to streamline data due to different currencies, tax regulations, and different tools used in other locations.

With smart financial reporting software, businesses can seamlessly integrate data across separate accounting systems and geographies. As a result, companies can now get 360-degree visibility into the organization’s performance. This, in turn, helps organizations to identify challenges and opportunities and take action in real-time.

Are you looking for smart financial reporting software to assess the financial stability of your business and track your liabilities and assets with ease? Look no further.

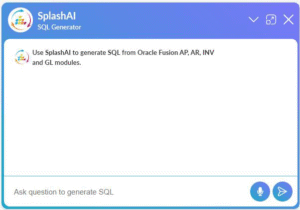

Introducing SplashGL – A New-Age Financial Reporting Software

Our product teams deep-dived into the needs of finance teams and financial reporting stakeholders to build a reporting platform that delivers results. We set out with the goal to meet the most urgent requirements listed above, and then we did a little extra.

With SplashGL, you can leverage your existing financial systems to speed-up processes and increase accuracy. Our software also enables you to adapt effortlessly to changing business conditions and provides users with a hassle-free experience.

SplashGL will help you deliver on-demand financial statement packages required by all stakeholders. It refreshes the financial packages in real-time or it uses Cube technology. With SplashGL by your side, you can manage financial reporting with Excel, along with a host of other features like –

- Drilldown

- Reconcile Balances

- Burst & Distribute

- Unlimited insights

- Research Templates for balances

- Custom hierarchies

- Budget reporting

- Auto discovers Oracle security elements like responsibilities, roles, and ledgers.

A more straightforward, more productive month-end closure process, more seamless reporting, and sound fiscal decisions across the enterprise.

Summing up

Financial reporting processes can make or break a business. From month-end processes that last weeks to compliance issues, indecision, and more, not choosing the right finance reporting tool can cause many roadblocks.

Organizations of all sizes are moving from legacy financial systems and software to modern, holistic ones that deliver better results with less effort. SplashGL is one such software that streamlines your reporting process for extraordinary performance and enhanced accuracy.

Contact us now and discover how you can transform your finance function to be more effective and strategic.

![The Secret Sauce for Financial Reporting Success [9 Tips Revealed] 2 Financial insights with SplashGL](https://b1005447.smushcdn.com/1005447/wp-content/uploads/2022/07/financial-insights-out-of-the-box-blog.jpg?lossy=0&strip=1&webp=1)